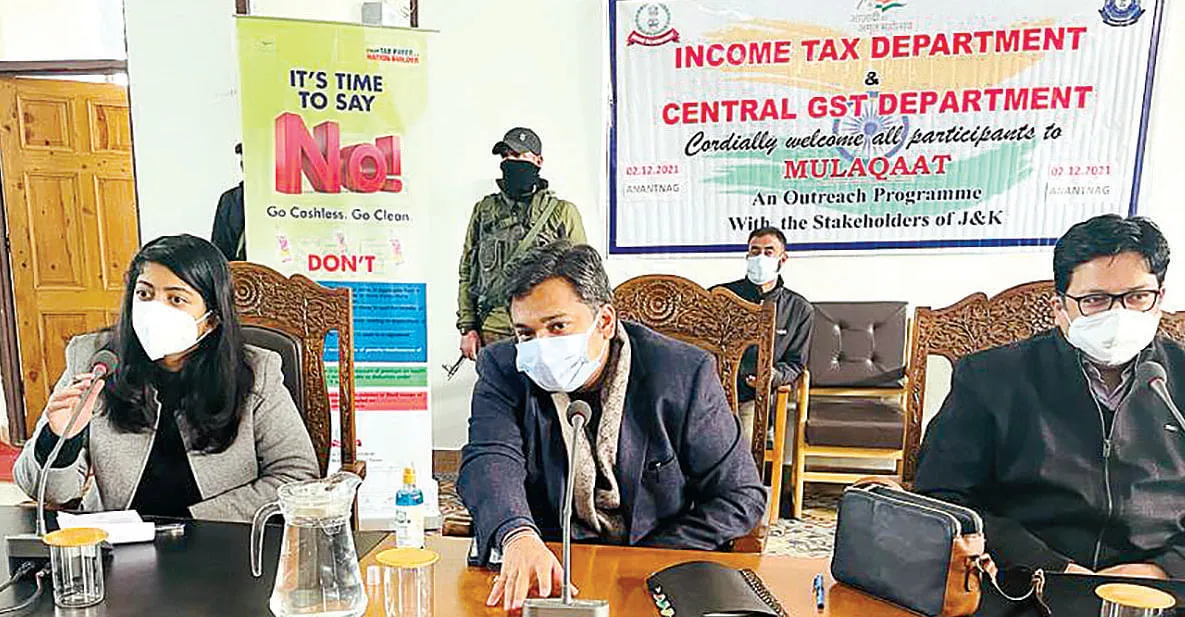

Srinagar: As part of outreach initiative of Union Ministry of Finance, joint programmes were conducted by the Central GST and the Income Tax Departments at Kulgam, Shopian districts on December 1 and Anantnag, Kupwara districts on Dec 2.

As per the statement issued here, the initiative is aimed at reaching out to representatives of small and medium industry, business professionals, local business bodies and associations, start-ups, women entrepreneurs to collect feedback on budget expectations and other aspirations. These programmes witnessed large and enthusiastic participation of the stakeholders.

Joint Commissioner, CGST, Vivek Gupta, gave a brief introduction about GST and explained that roll-out of GST in 2017 was a major reform wherein cascading effect of the taxes was mitigated, i.e., many of the state and central taxes (C. Ex. Duty, ST, VAT, Purchase Tax, Entry Tax Luxury tax) subsumed into one tax. i.e. GST.

“Now it is One Nation One Tax as tax is levied on the supply of goods or services at a uniform rate throughout the country.”

He further informed that there are NIL GST rates or low rates for goods required for basic consumption such as grains, salt, jaggery, vegetables, fruits etc.

“To ensure transparency and accountability, every communication sent by the Central Tax officers to the taxpayers his system generated a Document Identification Number (DIN).”

Danish Inder Singh Gill, Deputy Commissioner, Amandeep Talwar and Ravikesh Tripathi, Assistant Commissioners, elaborated various aspects of GST like composition levy scheme, e-invoicing, benefits for MSMEs, amnesty schemes, relaxation in compliance, Budgetary Support Scheme and COVID relief measures.

They also shared contact details and useful links to the CBIC website with the trade.

Later traders were invited to express their grievances and demands regarding GST reforms. The trade associations raised their concerns like difficulties encountered in filing various returns on the GST Portal, and requested for organizing more awareness programmes about GST and Income tax, in which people should be taught about TDS, GST Returns, IT Returns etc.

They also demanded that in view of internet connectivity issues in Kashmir, a suitable time window beyond the due date of filing of returns, free of late fee, should be provided.

Rajiv Gubgotra, Joint Commissioner, CBDT informed the traders about various reforms of Income tax like Faceless assessment of Income tax returns, introduction of New format of Income tax Portal to make it more user friendly and many other reforms and addressed the grievances of the participants regarding TDS, IT returns filing.

The Trade association thanked the Finance for providing them a platform where they could express their concerns and demands for GST reforms and Income tax related issues.